Introduction

Charitable giving has always been a reflection of generosity, values, and social responsibility. But in 2025, it has become much more than simply writing a check to a favorite nonprofit. Donors today are increasingly interested in aligning their philanthropy with long-term financial planning, ensuring that their giving is both impactful and tax-efficient. This is where the concept of charitable giving financial planning comes into play. By thoughtfully integrating donations into a broader wealth strategy, individuals and families can maximize the good they do for society while simultaneously optimizing their financial well-being.

The latest data shows charitable contributions in the U.S. reached historic levels in 2024, fueled by a mix of philanthropy from high-net-worth donors and grassroots supporters. At the same time, tax rules, retirement considerations, and evolving tools like donor-advised funds (DAFs) and Qualified Charitable Distributions (QCDs) are reshaping how people approach giving. As we move deeper into 2025, anyone who wants to give wisely needs to understand how philanthropy and financial planning intersect.

Understanding the Charitable Giving Landscape in 2025

The philanthropic landscape continues to evolve in response to economic conditions, market performance, and tax policy. While certain sectors—such as education, international aid, and civil rights—are seeing robust growth, others remain more dependent on traditional donor bases. Moreover, recent tax law changes have shifted the dynamics of who gives and how they give. For example, because the standard deduction remains relatively high, fewer households are itemizing deductions, which has pushed many individuals to adopt strategies like bunching donations into a single tax year.

A key point to note is that giving is becoming more “top-heavy.” Wealthy donors are increasingly responsible for a larger share of total contributions, while overall household participation has declined. This trend underscores the importance of structured approaches to charitable giving financial planning, ensuring that philanthropy is accessible and efficient across income levels.

Setting Philanthropic Objectives

Before diving into strategies, donors need to define their objectives clearly. Why do you want to give, and what outcomes do you hope to achieve? For some, philanthropy is about supporting community organizations or religious institutions. For others, it may be about advancing global health, education, or environmental sustainability. Identifying your “why” helps shape your “how.”

Equally important is determining the rhythm of your giving. Some individuals prefer recurring monthly donations to sustain charities year-round, while others concentrate their giving at year-end or during major life events such as business sales or retirement. Establishing impact goals, such as reducing overhead costs for nonprofits or funding specific programs, can also make philanthropy more strategic and measurable.

Tax-Efficient Giving Tools in 2025

When it comes to charitable giving financial planning, the methods you choose are just as important as the causes you support. Let’s explore the most effective tools available this year.

Donating Appreciated Assets

Donating highly appreciated stock, mutual funds, or even cryptocurrency remains one of the most powerful ways to give. Instead of paying capital gains taxes on these assets, donors can contribute them directly to a charity or a donor-advised fund. This allows the donor to claim a fair market value deduction while ensuring that more dollars go to the cause instead of the IRS.

Bunching Donations

Because the standard deduction often exceeds itemized deductions for many taxpayers, bunching has become a popular strategy. This involves combining several years’ worth of donations into a single year to exceed the itemization threshold. In alternate years, donors then take the standard deduction. Bunching ensures you maximize tax benefits without reducing overall generosity.

Donor-Advised Funds (DAFs)

DAFs continue to be one of the fastest-growing charitable vehicles. They allow donors to make a tax-deductible contribution upfront, invest the funds for potential growth, and recommend grants to charities over time. In 2025, DAFs are particularly appealing for individuals facing liquidity events such as stock option exercises, business sales, or large capital gains. They provide flexibility, immediate deductions, and a structured approach to giving.

Qualified Charitable Distributions (QCDs)

For individuals aged 70½ or older, QCDs offer a unique opportunity to donate directly from an IRA to a qualified charity. These distributions count toward required minimum distributions (RMDs) but are excluded from taxable income, providing significant tax savings. The 2025 indexed limits have made this tool even more attractive, especially for retirees looking to manage tax liability while maintaining charitable involvement.

Charitable Trusts and Gift Annuities

For high-net-worth families seeking more sophisticated approaches, charitable remainder trusts (CRTs), charitable lead trusts (CLTs), and charitable gift annuities (CGAs) offer advanced ways to blend philanthropy with estate planning. These vehicles allow donors to support causes while also generating income streams or transferring wealth to heirs in a tax-efficient manner.

Optimizing Your Annual Giving Plan

Creating an annual giving plan is an essential step in successful charitable giving financial planning. Start by aligning your donations with your cash flow, investment gains, or bonus income. For example, if you expect a large year-end bonus, plan your charitable contributions accordingly to offset taxable income.

Next, consider asset selection. In most cases, donating appreciated assets provides greater tax advantages than cash contributions. Think strategically about timing—donating during a market rally or while rebalancing your portfolio may maximize both impact and efficiency. Lastly, keep meticulous records. The IRS requires proper substantiation for charitable deductions, especially for non-cash gifts, so ensure you have receipts, appraisals, and acknowledgment letters.

Philanthropy, Retirement, and Estate Planning

One of the most powerful intersections between philanthropy and financial planning occurs in retirement and estate strategies. QCDs, as mentioned earlier, are particularly useful for retirees, as they allow charitable giving while reducing taxable income. Additionally, naming a charity as the beneficiary of a retirement account can be more tax-efficient than leaving those accounts to heirs, since charities do not pay income tax on distributions.

Estate planning can also include legacy letters, donor intent documents, and family governance structures that pass values along with wealth. By weaving philanthropy into retirement and estate planning, donors can ensure their generosity extends well beyond their lifetime.

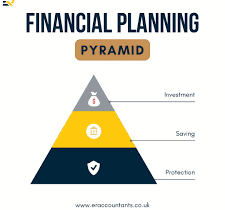

Comparing Giving Vehicles

When considering how to structure your giving, it’s helpful to compare the main vehicles: direct gifts, donor-advised funds, private foundations, and charitable trusts. Direct gifts are simple and immediate, while DAFs offer flexibility and growth potential. Private foundations provide control and prestige but come with higher administrative burdens. Trusts and annuities are best suited for high-net-worth individuals seeking long-term planning benefits. Evaluating costs, control, and impact can help donors choose the right path.

Due Diligence on Nonprofits

Effective giving isn’t only about how much you donate—it’s also about ensuring your contribution creates meaningful impact. Donors should conduct due diligence on nonprofits by reviewing their mission alignment, governance practices, and financial health. Tools like IRS Form 990s, nonprofit ratings, and audited statements can help evaluate transparency and effectiveness. Supporting organizations with unrestricted or multi-year funding may also enhance long-term stability and outcomes.

Giving Across Market Cycles

Charitable giving often fluctuates with market performance. In strong years, donors may feel more confident contributing larger amounts, while downturns can challenge generosity. By incorporating philanthropy into investment planning, donors can smooth contributions across cycles. For example, rebalancing portfolios during market rallies can provide appreciated assets to give away, ensuring that giving remains consistent even during uncertain times. Liquidity events, such as selling a business or exercising stock options, are also prime opportunities to contribute strategically before realizing taxable gains.

Family and Corporate Philanthropy

Many families use charitable giving as a way to instill values in younger generations. Creating a family giving council or involving children in decision-making fosters responsibility and empathy. On the corporate side, business owners and executives are increasingly aligning philanthropy with corporate social responsibility (CSR) and environmental, social, and governance (ESG) goals. For entrepreneurs, integrating giving into business structures can enhance brand reputation while supporting meaningful causes.

Compliance and Risk Management

With all the benefits of charitable giving comes responsibility. Donors must remain compliant with IRS rules regarding quid pro quo contributions, substantiation requirements, and valuation of non-cash gifts. International giving may also require additional oversight to ensure funds reach qualified organizations. For private foundations and trusts, avoiding self-dealing or excess benefit transactions is essential to maintaining tax-advantaged status.

Conclusion

Charitable giving in 2025 is no longer just about generosity—it is about strategy, alignment, and efficiency. By integrating philanthropy into a comprehensive financial plan, donors can amplify their impact on society while maximizing tax benefits and long-term wealth goals. Whether through donor-advised funds, QCDs, bunching strategies, or sophisticated trusts, there are more tools than ever to make giving both rewarding and efficient.

In short, charitable giving financial planning is the bridge between generosity and strategy. By combining heart and mind, today’s donors can leave a legacy of meaningful change while securing their own financial future.

Do Read: Success100x.com Factors: Unlocking Exponential Growth