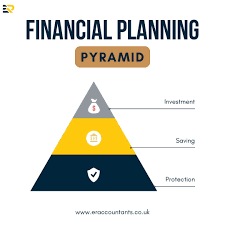

When it comes to personal finance, many people feel overwhelmed by the number of choices and the complexity of investment options. The financial planning pyramid offers a clear, visual framework to help prioritize and organize financial decisions in a logical, step-by-step manner. By working from the bottom up, this approach ensures that you build a secure financial foundation before moving into higher-risk, high-reward opportunities. Whether you’re just starting your financial journey or looking to refine your existing plan, understanding this pyramid is essential to creating sustainable, long-term wealth.

Understanding the Financial Planning Pyramid

The financial planning pyramid is a structured model that organizes financial priorities into layers. The base of the pyramid represents the safest and most essential aspects of your financial life—things like emergency funds, insurance coverage, and debt management. As you move upward, each layer introduces investments with progressively higher levels of risk and potential return.

The beauty of the pyramid is its adaptability. It’s not a rigid, one-size-fits-all system; instead, it serves as a guide you can tailor to your goals, risk tolerance, and life stage. By following the pyramid’s progression, you can reduce financial stress, protect against unexpected events, and steadily grow your wealth over time.

Base Layer – Financial Security & Protection

Every strong financial plan begins with a solid foundation. In the financial planning pyramid, this is the base layer, and it’s designed to protect you from life’s unexpected challenges. Without this security, moving into higher investment tiers can be risky.

Emergency Fund

An emergency fund is your first line of defense against financial setbacks. This is a cash reserve—ideally enough to cover three to six months of living expenses—kept in a highly accessible account, such as a savings account or money market fund. Its purpose is simple: to prevent you from going into debt or selling investments at a loss when unexpected costs arise, such as medical bills, job loss, or urgent home repairs.

Insurance Coverage

Insurance is another cornerstone of the foundation. Health insurance protects against expensive medical bills, life insurance ensures your family’s financial stability if something happens to you, and disability insurance safeguards your income if you can’t work due to injury or illness. Home or renter’s insurance protects your property, and liability coverage shields you from legal claims.

Debt Management

High-interest debt—especially from credit cards—can erode financial stability. Paying down these debts is a crucial part of securing your base layer, as interest charges can outpace the returns from most investments.

Middle Layer – Stable Growth Investments

Once your foundation is secure, you can move into the middle layer of the financial planning pyramid: low- to moderate-risk investments designed to grow your wealth steadily while preserving capital.

This layer often includes:

- Bonds and Bond Funds: Government and high-grade corporate bonds offer stable returns with relatively low risk.

- Index Funds and ETFs: These provide broad diversification and are less volatile than individual stocks.

- Retirement Accounts: Contributions to 401(k)s, IRAs, or similar tax-advantaged accounts help grow wealth over the long term while offering tax benefits.

The goal here is balance—achieving returns that outpace inflation without exposing your portfolio to unnecessary volatility. Many people find that a mix of fixed-income and equity investments works well in this layer.

Upper Layer – High-Growth and Speculative Investments

At the top of the financial planning pyramid are high-risk, high-reward investments. These assets can generate significant returns, but they also carry the possibility of substantial losses.

Examples include:

- Individual Stocks: Particularly growth stocks in emerging industries.

- Real Estate: Property investments can yield rental income and appreciation, but also require management and carry market risk.

- Business Ventures: Starting or investing in a business offers high upside potential but significant risk.

- Cryptocurrencies and Alternative Assets: While these can produce extraordinary gains, they are volatile and unpredictable.

Only a small percentage of your portfolio should be allocated to this layer, and only after your lower layers are entirely in place.

Customizing the Pyramid for Your Financial Goals

The financial planning pyramid is flexible and should reflect your unique situation. Younger investors with decades ahead before retirement may choose to allocate more to equities and growth assets. Conversely, retirees or those approaching retirement often focus more on income stability and capital preservation.

Key factors that influence your pyramid design include:

- Age: Time horizon affects how much risk you can take.

- Income Level: Higher income can allow for more aggressive investing, but only if the base is secure.

- Risk Tolerance: Your comfort level with market swings determines allocation choices.

- Financial Goals: Funding a home purchase, paying for education, or preparing for retirement each requires a different approach.

Step-by-Step Plan to Build Your Financial Pyramid

Assess Your Current Financial Health

Begin by calculating your net worth, reviewing income and expenses, and identifying financial strengths and weaknesses.

Build an Emergency Fund

Save until you have at least three to six months of living expenses set aside.

Secure Adequate Insurance

Ensure you have the right coverage for health, life, disability, property, and liability.

Start with Stable Investments

Begin contributing to retirement accounts and consider bonds, index funds, or balanced mutual funds.

Gradually Move into Higher-Risk Investments

Once the lower layers are solid, you can allocate a small portion to speculative assets.

Review and Adjust Regularly

Life changes—marriage, children, career shifts—require updates to your financial pyramid.

Common Mistakes to Avoid

While the financial planning pyramid is straightforward, it’s easy to make mistakes:

- Skipping the Foundation: Jumping straight into high-risk investing without protection can lead to financial disaster.

- Over-Allocating to Speculative Assets: Even if markets are booming, too much exposure to volatile investments increases the risk of significant losses.

- Neglecting Updates: A pyramid built for your 20s won’t necessarily suit your 40s or 60s.

Benefits of Following the Pyramid Approach

The financial planning pyramid offers several advantages:

- Clarity: It visually organizes your priorities, making decisions easier.

- Risk Management: By securing your foundation first, you reduce exposure to catastrophic losses.

- Long-Term Growth: A balanced, layered approach supports sustainable wealth building.

- Adaptability: It can be tailored to suit any financial situation or life stage.

Conclusion & Action Plan

The financial planning pyramid is more than just a diagram—it’s a proven roadmap to economic stability and wealth. By starting with a secure base, moving gradually into stable growth investments, and carefully adding higher-risk assets at the top, you can build a resilient portfolio that weathers market fluctuations and supports your long-term goals.

If you haven’t yet structured your finances this way, the best time to start is now. Assess your current situation, fortify your foundation, and begin building upward. Over time, this disciplined approach will help you achieve not only financial security but also the freedom to pursue the life you want.