Introduction: What Is Holistic Financial Planning?

Holistic financial planning is an all-encompassing approach to managing money that focuses on the entire financial life of an individual or family rather than isolated elements like investments or budgeting alone. It integrates every aspect of financial well-being—income, spending, savings, insurance, taxes, retirement, and estate planning—into one cohesive strategy designed to achieve life goals and long-term stability. Unlike traditional financial planning, which often centers only on numbers and returns, holistic financial planning aligns financial decisions with personal values, priorities, and lifestyle objectives. In today’s uncertain economy, this comprehensive approach empowers people to gain clarity, reduce financial stress, and build a future grounded in purpose and control.

The Core Principles Behind Holistic Financial Planning

At its foundation, holistic financial planning rests on several key principles: integration, balance, and intentionality. It begins with the idea that every financial decision affects another—your tax strategy influences your investment returns, your insurance choices affect your estate plans, and your debt management impacts your savings. A holistic planner doesn’t treat these as separate issues but weaves them together into one actionable plan. The approach also emphasizes value-driven decision-making. Rather than chasing market trends or quick returns, it focuses on aligning money with meaning—funding what truly matters to you, whether that’s family security, business growth, or charitable giving. The ultimate goal is to create harmony between financial choices and personal fulfillment.

The 7-Step Holistic Financial Planning Process

Certified Financial Planners (CFPs) often use a seven-step process to ensure a thorough and personalized financial plan. Step one involves establishing a professional relationship built on trust, transparency, and clear expectations. Step two collects essential financial data, including income, assets, liabilities, and spending habits. Step three clarifies personal and financial goals—both short-term desires like buying a home and long-term ambitions such as retiring comfortably. Step four analyzes your current financial situation to identify gaps and opportunities. Step five develops a customized strategy that integrates all aspects—investments, insurance, taxes, and estate plans—into a single blueprint. Step six is about implementation: executing the plan through disciplined action. Finally, step seven ensures continuous monitoring and adjustments as life, markets, or priorities change. This iterative cycle makes holistic financial planning a living, evolving process rather than a one-time event.

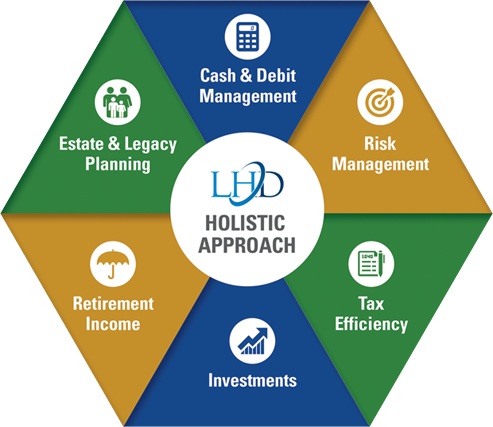

Core Components of a Holistic Financial Plan

A complete holistic financial plan covers every dimension of your financial life. It starts with cash flow management, ensuring that your income and spending align with your goals. Next comes building an emergency fund, usually covering three to six months of essential expenses, to safeguard against unexpected shocks. Debt management is another crucial area—strategically paying off high-interest loans while maintaining good credit health. On the investment side, asset allocation and diversification ensure that your portfolio matches your risk tolerance and time horizon. Insurance planning protects your family and assets from unforeseen events through proper life, disability, and property coverage. Tax planning focuses on optimizing your income and investments to reduce tax liabilities legally and efficiently. Finally, retirement and estate planning secure your future income and legacy, making sure your loved ones are protected and your wealth is transferred smoothly. These interlinked components create a robust and adaptive financial ecosystem.

Behavioral Finance: The Psychology of Money Decisions

Even the most technically sound plan can fail without behavioral discipline. Holistic financial planning acknowledges the powerful influence of emotions and psychology on financial behavior. Many people fall prey to common biases like loss aversion, where fear of losing money outweighs potential gains, or overconfidence, where one assumes excessive control over unpredictable outcomes. Behavioral finance addresses these tendencies through awareness and structured decision-making. A financial planner acts as a behavioral coach, guiding clients to stay the course during market volatility, resist impulsive decisions, and remain committed to long-term goals. Techniques such as automated savings, predefined rebalancing schedules, and scenario planning help individuals maintain consistency and avoid reactionary mistakes. By blending rational analysis with emotional intelligence, holistic planning strengthens both the numbers and the mindset behind them.

Benefits of Holistic Financial Planning

The advantages of holistic financial planning extend far beyond wealth accumulation. One of its most significant benefits is financial clarity—a clear understanding of where you stand and where you’re headed. It also enhances goal alignment, ensuring that every dollar you earn serves a purpose. By integrating all financial aspects, it prevents inefficiencies, overlaps, and blind spots that often arise when handling money piecemeal. Another major benefit is stress reduction. When you have a well-structured plan with contingency options, financial uncertainty feels less overwhelming. Over time, holistic planning leads to sustainable wealth creation, helping you grow assets strategically while protecting against unnecessary risks. For families, it fosters intergenerational financial security, ensuring future generations inherit not just money but a framework of responsible financial habits.

How to Create Your Own Holistic Financial Plan

While hiring a professional planner can add expertise and accountability, individuals can also begin holistic financial planning independently. Start by defining your values and goals—what does financial success mean to you personally? Next, gather detailed data on income, expenses, assets, debts, and insurance policies. Create a realistic budget that reflects both your lifestyle and savings objectives. Build or increase your emergency fund, then focus on debt reduction using methods like the snowball or avalanche approach. Once your foundation is stable, design an investment strategy that suits your risk tolerance and timeline. Regularly review your insurance coverage to ensure adequate protection. Finally, plan for long-term objectives such as retirement, estate distribution, and charitable contributions. The key is to maintain balance: a plan that’s too rigid can stifle progress, while one too flexible can lose direction. Reviewing your plan at least annually keeps it relevant and effective.

Technology and Tools for Modern Financial Planning

Digital tools have made holistic financial planning more accessible and accurate than ever. Platforms like MoneyGuidePro, eMoney, and RightCapital allow users and advisors to visualize their entire financial landscape in real time. These programs integrate cash flow analysis, tax projections, and investment performance, providing an interactive experience for setting and tracking goals. Mobile apps like Mint, YNAB (You Need a Budget), and Personal Capital help individuals monitor daily expenses and net worth with ease. Automation tools can handle recurring transfers, bill payments, and even rebalancing investments, reducing human error. Artificial intelligence has also begun transforming financial planning by analyzing patterns, forecasting risks, and personalizing advice. Leveraging technology not only saves time but enhances decision-making by providing data-driven insights aligned with your overall financial objectives.

Real-World Examples and Case Studies

Consider a young professional starting her career who uses holistic financial planning to balance student loan repayment, emergency savings, and retirement investing. By following a structured plan, she gains control over her cash flow and begins building wealth early. Another example is a mid-career couple juggling mortgage payments, children’s education costs, and retirement goals. Through a holistic review, they discover tax advantages and optimize their insurance coverage, improving cash efficiency. A retiree, on the other hand, applies holistic principles to manage withdrawals from multiple accounts, maintaining sustainable income while minimizing taxes. These case studies illustrate that holistic financial planning adapts to every stage of life, making it universally beneficial.

Frequently Asked Questions (FAQs)

Is holistic financial planning only for the wealthy?

No. It’s suitable for anyone who wants to take control of their finances, regardless of income level. Holistic planning scales according to needs and resources.

How often should I update my financial plan?

Review your plan at least once a year or whenever major life changes occur, such as marriage, job shifts, or inheritance.

What’s the difference between a financial advisor and a holistic planner?

A financial advisor may focus mainly on investments, while a holistic planner examines your full financial picture, including insurance, taxes, and long-term goals.

Can holistic planning help during inflation or recessions?

Yes. Because it includes emergency funds, risk management, and diversified investments, it helps cushion the impact of economic downturns.

Final Thoughts: Building a Financially Fulfilled Life

Holistic financial planning is more than managing money—it’s about creating alignment between your financial decisions and your life’s purpose. It encourages you to think beyond immediate gains and focus on sustainable growth, stability, and fulfillment. By understanding how each part of your financial life connects, you can make smarter, more intentional choices that lead to long-term prosperity. Whether you start on your own or work with a Certified Financial Planner, the key is to begin now. The earlier you integrate holistic financial principles into your life, the sooner you can experience peace of mind, financial freedom, and a sense of control over your future. In essence, holistic financial planning is not just a financial strategy—it’s a lifelong philosophy for achieving balance, security, and meaning with your money.

Do Read: Financial Planning Jobs: Unlocking a Prosperous Future in the World of Finance